What Makes Buying A Foreclosed Property Risky – Full Guide!

Buying a foreclosed property is a risk because it may have hidden damage or outstanding bills. These homes are often sold “as is,” meaning they may require expensive repairs. The buying process can also be complicated and take longer.

Stay connected as we explore the risks associated with buying a foreclosed property. We will also share the potential problems you might face and provide guidance on how to avoid them.

What Is A Foreclosure Property?

A foreclosure property is a home that a bank takes back from the owner when the owner does not pay the home loan. The bank then tries to sell the home to get back the money it gave in the loan. These homes are often sold at low prices.

What Are The Different Types Of Foreclosures?

There are four main types of foreclosures. Based on law and loan terms, different states use different types.

- Judicial foreclosure.

- Non-judicial foreclosure.

- Strict foreclosure.

- Government foreclosure.

Judicial vs. Non-Judicial:

| Point | Judicial Foreclosure | Non-Judicial Foreclosure |

| Court use | Yes | No |

| Time | Slow process | Fast process |

| Cost | More expensive | Less expensive |

| How it starts | The lender goes to court | The lender follows the loan paper rules |

| Where it happens | In all states | Only in some states |

| Owner safety | More safety for the owner | Less safety for the owner |

What Are The Common Reasons For Foreclosures?

A foreclosure happens when a homeowner does not pay the home loan. Then the bank or lender takes the home back. Below are some common reasons why this happens:

- The owners cannot pay the loan: This is the main reason. Many people lose jobs or face money problems, and then they cannot pay the loan on time, which can lead to foreclosure.

- The owners pass away: If the owner dies and no one can pay the loan, the home may be foreclosed. Sometimes there is no family to take care of the loan or the home.

- The owners get divorced: One person may get the home after the divorce. If both were paying before, one person may be unable to pay alone. This can also cause foreclosure.

Why Are Foreclosed Properties So Inexpensive?

Lenders want to sell foreclosed properties quickly because they must pay for insurance, property taxes, and repairs if they do not. If the home stays empty for too long, it can be damaged.

Lenders often sell foreclosed properties at much lower prices to avoid these costs. The fastest way to sell these homes and get back the money they are owed is by auctioning them to the highest bidder.

Why Are Foreclosures Risky?

Investing in a foreclosed property may seem like a good deal because of the low price. However, it comes with risks. Here are some reasons why investing in foreclosures can be risky:

1. Foreclosures Are Sold “As-Is”:

When you buy a foreclosed property, it is sold “as-is.” This means you have to pay for all repairs. Sometimes, the previous owner may have caused damage, and you may have to spend a lot of money fixing it.

2. You cannot Inspect A Foreclosed Property In Advance:

You can inspect the property in a regular home sale before buying it. But you usually cannot do this in a foreclosure, especially at an auction. This is risky because you will not know the property’s actual condition.

3. The Property May Need A Lot Of Work:

Some foreclosed homes need so many repairs that it may not be worth fixing. If the house is old or in a bad area, selling it for a reasonable price could be hard, even after repairs.

4. The Property May Have Been Vacant For Years:

A foreclosed property may have been empty for a long time. This can lead to problems like vandalism, squatters, and damage. You might need to spend a lot of money to make the house livable again.

5. Investors May Get Stuck With Liens:

If the previous owner didn’t pay taxes or fees, you may have to pay them. These unpaid costs are called liens. If you don’t check for these first, it can cost you much extra money.

6. Investors May Not Know The Actual Value Of The Property:

You may not have all the necessary details when buying a foreclosed property. This makes it hard to know the property’s real value. You could end up overpaying for a home that is not worth your pay.

7. There Is Strong Competition From Other Buyers:

Foreclosed properties are cheap, so many people want to buy them. You may have to compete with other buyers, which can increase the price. This could cause you to overpay.

8. The Purchasing Process Is Complicated:

Buying a foreclosed property can be a long and complicated process. There are rules you may not know about, like redemption rights. This means the previous owner might be able to reclaim the property after the auction, causing you to lose it even if you win the bid.

How To Buy Foreclosed Homes From Banks?

Buying a foreclosed home from a bank involves a straightforward process. Here is a step-by-step guide to help you through it:

- Find Homes: Look online for foreclosed homes sold by banks.

- Get Loan Approval: Get pre-approved for a loan to show you can afford the home.

- Visit the Home: Check the home to see its condition.

- Make an Offer: Offer the bank the price you want to pay.

- Wait for Approval: Wait for the bank to accept your offer.

- Close the Sale: Finish the paperwork and buy the home once accepted.

Should You Turn Over Foreclosed Properties?

Yes, turning over foreclosed properties can be profitable if you buy low, fix them up, and sell for a higher price. However, repairs can be expensive, and you may not know about hidden problems. Make sure you are ready for the risks and costs before starting.

What Are The Financing Challenges When Buying A Foreclosure?

Buying a foreclosure can be difficult when it comes to financing. Here are some challenges you may face:

- It’s Harder to Get a Loan: Many banks may be hesitant to lend money to purchase a foreclosed property due to its condition.

- Cash Needed for Repairs: Since foreclosed homes are often sold “as-is,” you may need extra cash to fix any damage.

- Limited Loan Options: Some standard loans may not cover the costs of buying a foreclosure so you may need a special loan like an FHA 203(k).

- Higher Down Payment: Lenders may require a larger down payment for foreclosures due to their risk.

- Longer Approval Time: The approval process for foreclosure loans can take longer than regular home loans.

Can You Get Financing For A Foreclosed Property?

Yes, you can get financing for a foreclosed property through options like conventional loans, FHA 203(k) loans, or hard money loans. However, the property may need to be in good condition or require extra cash for repairs.

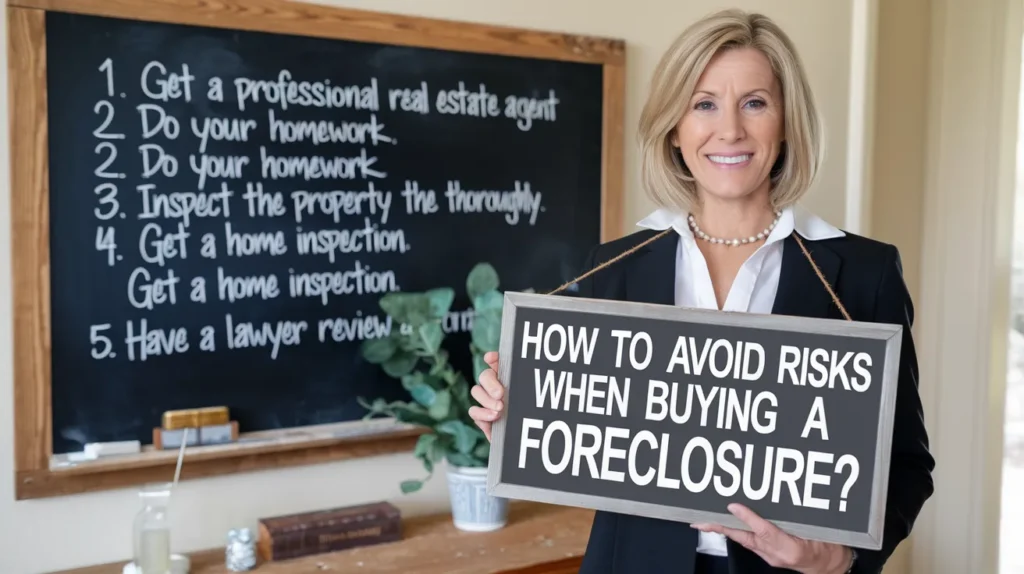

How To Avoid Risks When Buying A Foreclosure?

Buying foreclosed properties comes with risks, but you can reduce those risks with some helpful tips. Here are a few ways to avoid mistakes when buying a foreclosed property:

1. Be Aware Of Local Lien Laws:

Make sure you know the lien laws in your state. Some states require the buyer to pay unpaid liens, while others require them to be paid before the sale.

2. Do Not Overpay:

Just because a property is foreclosed does not mean it is a bargain. Research the value of similar properties in the area and aim to pay no more than 70% of the property’s after-repair value (ARV).

3. Maintain A Money Reserve:

Set aside extra money for unexpected repairs or higher costs. This will help cover any surprises that come up after the purchase.

4. Find A Real Estate Agent Who Specializes In Foreclosures:

Get help from a real estate agent who knows foreclosures. They can guide you through the process and help you find a good deal.

5. Recognize The Competition:

There may be other investors bidding on the same property. Watch their bids closely and avoid getting caught up in a bidding war. Your goal is to buy at a fair price, not to overpay.

What Should You Know Before Buying A Foreclosure?

Foreclosures can be a good way for investors to buy a property at a lower price. However, risks are involved, so knowing your options before buying is essential. One of the best things you can do is talk to a real estate financing expert.

They can explain the risks and rewards of investing in foreclosures and help you decide if it is a good idea. They can also guide you in finding the best financing option for your situation.

FAQ’s:

1. What is the cheapest way to buy a foreclosed home?

The cheapest way to buy a foreclosed home is usually through a foreclosure auction or bank-owned sale, where properties are sold at lower prices.

2. Can you buy a foreclosed home with a conventional loan?

Yes, you can buy a foreclosed home with a conventional loan but it must be in good condition and meet the lender’s requirements.

3. Should I buy a foreclosure for my first home?

Buying a foreclosure for your first home can be risky, especially if you are unfamiliar with repairs or foreclosures.

4. Why do not realtors like foreclosures?

Real estate agents may not like foreclosures because they often involve complications such as long timelines, hidden damage, and uncertain legal issues.

5. Should you ever buy a foreclosed home?

You can buy a foreclosed home if you are prepared for the risks, like needing repairs or dealing with competition from other buyers.

6. What special concerns do foreclosed properties often present?

Foreclosed properties often require repairs, may have unpaid liens and may be harder to finance due to their condition.

YouTube Video Guide:

Conclusion:

Buying a foreclosed home can be a great deal, but it comes with risks. Make sure you do your research, understand the process, and be prepared for possible repairs. With the right approach, you can turn a foreclosure into a smart investment.

You Also Have To Check:

Post Comment